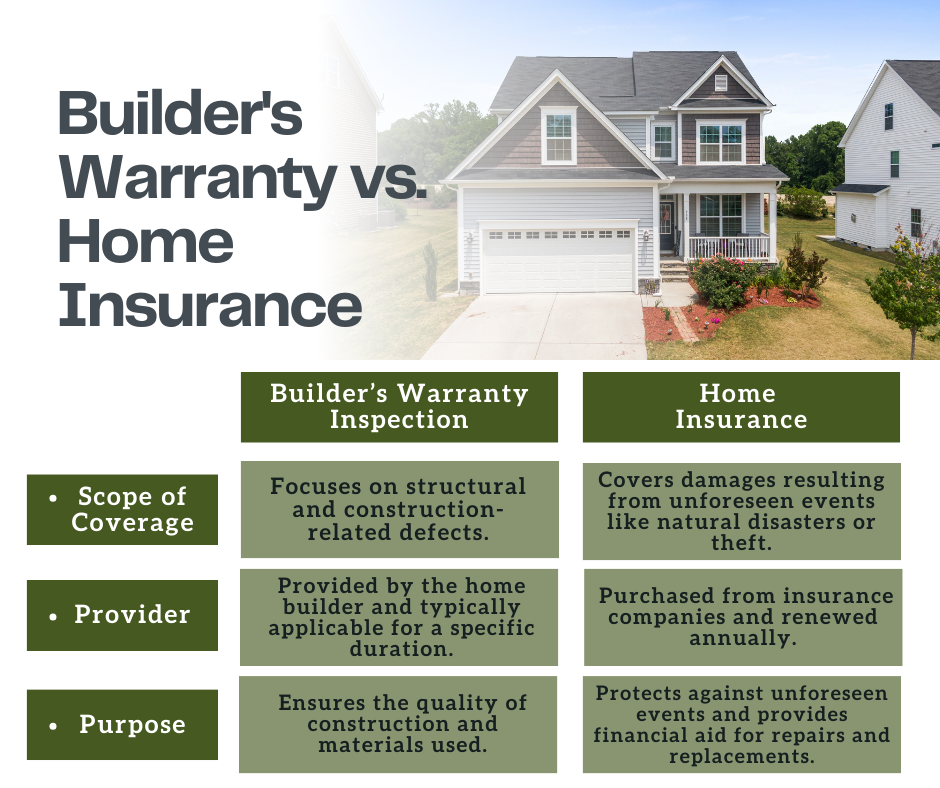

Buying a new home is an exciting venture, but it comes with its fair share of responsibilities and decisions. Among the numerous considerations, understanding the distinctions between a builder’s warranty and home insurance is crucial.

What is a Builder’s Warranty?

When you purchase a newly constructed home, it often comes with a builder’s warranty, sometimes known as a structural warranty or new home warranty. This warranty is provided by the builder and typically covers specific components of the home for a set period, often ranging from one to ten years.

What does Builder’s Warranty Cover?

What is a Home Insurance?

Home insurance, on the other hand, is a policy you purchase to protect your property from various risks, such as natural disasters, theft, and accidents. It doesn’t cover issues related to the construction of the house or defects resulting from poor workmanship.

What Does Home Insurance Cover?

Builder’s Warranty vs. Home Insurance: Key Difference